Private capital deal activity decelerated from 2H 2021 amid increasing geopolitical turmoil, rising inflation and global economic uncertainty. Yet the pace of investment remained high by historical standards.

Key Insights:

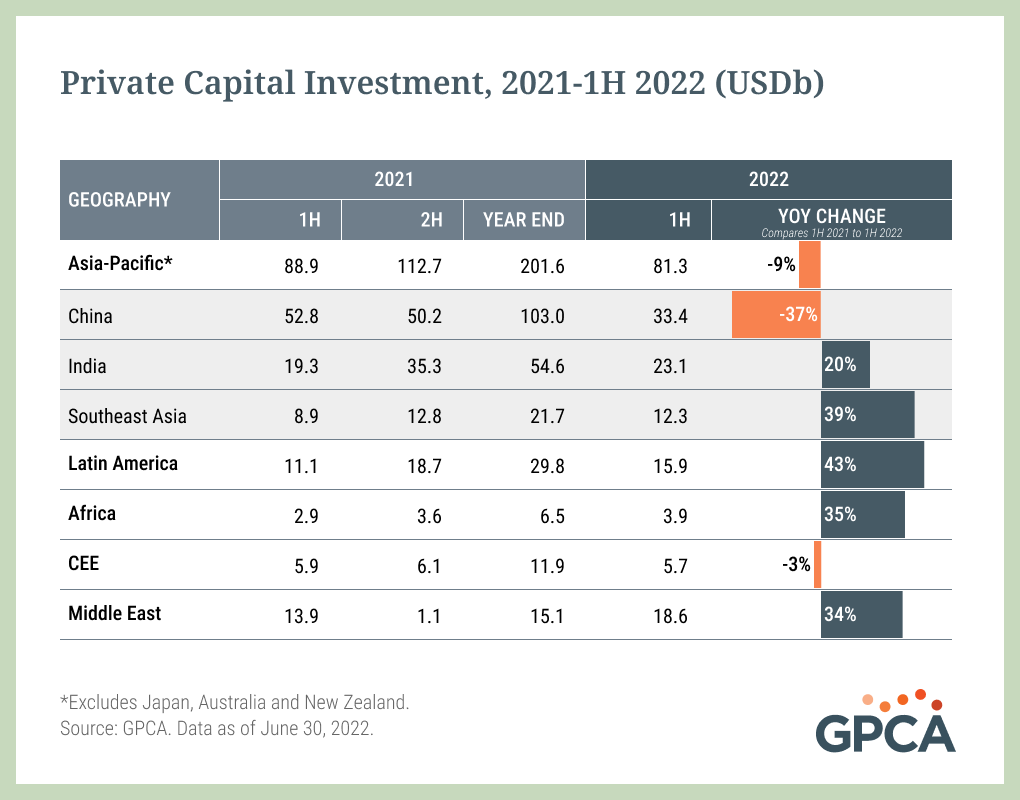

- Overall private capital deal values for 1H 2022 increased Y-o-Y in India, Southeast Asia, Latin America, Africa and the Middle East.

- Africa, the Middle East, India and Southeast Asia were bright spots for VC activity, with VC investment up 80%+ over 1H 2021. CEE VC investment hit a record high of USD4.3b in 1H 2022, but Q2 activity slowed as the war in Ukraine escalated.

- China private capital activity fell 37%, Y-o-Y, as prolonged lockdowns affected the economic outlook. Tech deals in 1H 2022 were concentrated in sectors aligned with Beijing’s five-year plan: semiconductors and hardware; electric vehicles and healthcare.

- Investment activity in green industries such as electric vehicles continued to grow, no longer confined to first-mover countries like China, with notable big ticket deals in Croatia (Rimac) and India (Ola Electric).

- Private capital investments in food and agriculture increased since the beginning of the pandemic.

GPCA’s Industry Data & Analysis is available on a quarterly basis exclusively for GPCA Members. GPCA’s Mid-Year 2022 Industry Data & Analysis includes additional insights on:

- 3,110 disclosed and verified private capital transactions across Asia, Latin America, Africa, Central & Eastern Europe, and the Middle East, including 2,744 venture transactions

- Growth sectors for private capital and VC investment

- China buyout activity and investment in deep tech sectors

- Investments totaling USD18.5b in conventional and new energy platforms

- Investments in food and agriculture

In addition, Members can access the Data Room platform to view and download GPCA’s complete fund- and deal-level dataset.