Member Program: Learning from Practitioners: GP-Led Secondaries

This program was open to EMPEA GP members exclusively. Please log in to view a recording of the program.

Member Program: Learning from Practitioners: GP-Led Secondaries

The current crisis has sparked increased interest in secondaries as a solution for liquidity. This practical training program took an in-depth look at these complex transactions, current and anticipated trends, and key considerations for GPs. Dedicated time was allowed for interactive participation and questions from attendees.

Part I: EM Secondaries Market Overview

This module was devoted to an in-depth conversation with representatives from Lexington Partners and Evercore on what practitioners are seeing in the market, including the drivers of demand.

Part II: Understanding GP-Led Secondary Transactions in Practice

In this module, representatives from Debevoise & Plimpton was address the conditions and processes around how secondaries work in practice, including key terms, structures, and players as well as the pros and cons of these deals.

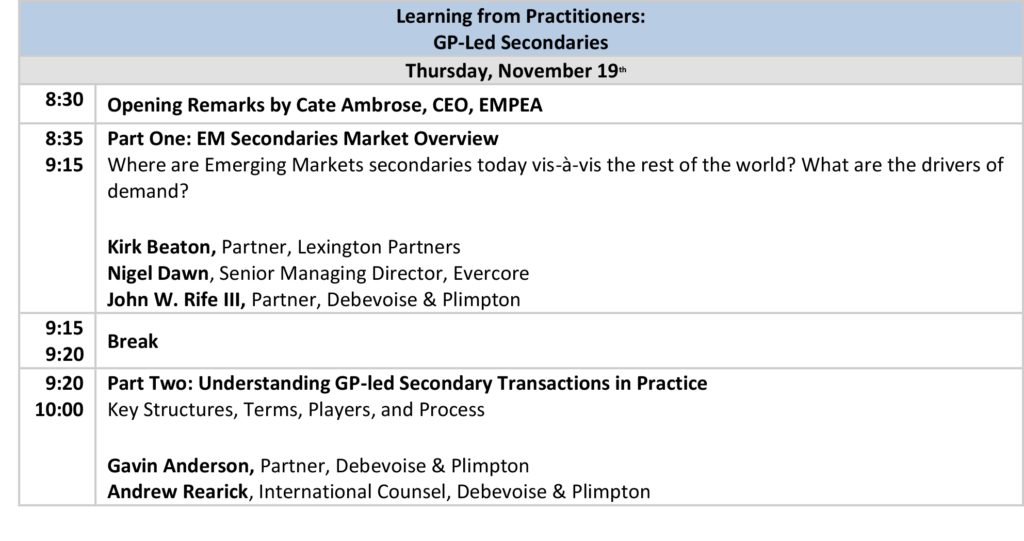

Agenda

Gavin Anderson

Partner

Debevoise & Plimpton

Gavin Anderson is based in the Hong Kong office and is a member of the firm’s Investment Funds and Investment Management Group. He has broad experience in advising sponsors and investors on a variety of issues, including fund formation, co-investment, fund restructurings, and carried interest arrangements. Learn more about Mr. Anderson here.

Kirk Beaton

Partner

Lexington Partners

Kirk Beaton is a Partner of Lexington Partners primarily engaged in the origination and evaluation of secondary purchases of non-U.S. private equity and alternative investments. Prior to joining Lexington in 2003, Mr. Beaton was an analyst in investment banking at Morgan Stanley.

Mr. Beaton graduated from the University of Strathclyde in Glasgow with an LLB (Honors) and Universität Hamburg and Universidad Complutense de Madrid with a European masters in economics and law.

Nigel Dawn

Nigel Dawn

Senior Managing Director

Evercore

Nigel Dawn is a Senior Managing Director and Head of Evercore’s Private Capital Advisory Group.

With a team based in the United States, Europe, and Singapore, Mr. Dawn is responsible for originating, developing and managing secondary market transactions for owners and managers of private financial assets seeking liquidity in the secondary market. Mr. Dawn has represented public pensions, university endowments, financial institutions, public quoted investment vehicles and other owners of private financial assets. Mr. Dawn was previously the Global Co-head of the Private Funds Group at UBS Investment Bank. At UBS Investment Bank, Mr. Dawn was responsible for founding and leading the Secondary Market Advisory business globally, and prior to this, was responsible for UBS Investment Bank’s investments in private equity funds. Mr. Dawn’s career began in international commercial banking with Standard Chartered Bank and following his MBA was a management consultant at Booz*Allen and Hamilton in New York.

Mr. Dawn graduated with a BA (Hons.) in Politics and East Asian Studies from the University of Newcastle-Upon-Tyne, and earned his MBA degree at the Columbia Business School.

Andrew Rearick

Partner

Debevoise & Plimpton

Andrew Rearick is a U.S.-qualified (New York and Massachusetts) and English-qualified international counsel in the Corporate Department. His practice covers a full range of cross-border corporate transactional matters for private equity and other institutional investors, as well as corporates, focusing in particular on mergers & acquisitions, joint ventures and other transformative transactions involving businesses centered in Europe, North America and emerging markets. Andrew is also a leader in the firm’s Alternative Asset and Secondary Investments Group, where he regularly advises general partners, secondaries fund sponsors, sovereign wealth funds and other investors on secondary transactions, GP-led restructurings and tender offers, preferred equity investments, co-investments and GP staking transactions. He has advised on transactions across many industries but has particular experience in the financial services, telecommunications, media and technology, and energy and natural resources sectors. Learn more about Mr. Rearick here.

John W. Rife III

Partner

Debevoise & Plimpton

John Rife is an English-qualified partner in the Corporate Department and a member of the firm’s Funds/Investment Management Group, where he advises institutional and independent sponsors of buyout, debt, secondaries, real estate, emerging markets, infrastructure, and energy funds, as well as funds of funds, on a broad range of matters, including fund formation and ongoing operational matters, co-investments, carried interest arrangements, and internal reorganizations. In addition, Mr. Rife is a leader in the firm’s Alternative Asset and Secondary Investments Group and regularly advises sponsors and investors on secondary transactions including GP-led fund restructurings and tender offers, LP interest portfolio transactions, fundless sponsor transactions, and other fund-related transactional matters. Learn more about Mr. Rife here.